+91 7400480777 /

+91 7400481777 / 022-35204499

+91 7400480777 /

+91 7400481777 / 022-35204499

Latest articles on Life Insurance, Non-life Insurance, Mutual Funds, Bonds, Small Saving Schemes and Personal Finance to help you make well-informed money decisions.

In the world of passion investing, splurging is not always spending but a thoughtful and well-calculated investment strategy to diversify and boost the portfolio.

Passion investing is increasingly becoming an important alternative investment vehicle, with most of the affluent investors allocating some portion of their corpus towards their passion. Buying a vintage car, collecting fine wines, treasuring fine arts, or indulging in luxury handbags, all can become a part of passion investing and can yield stupendous returns over time.

Alternatives deliver

It suggests that investment is not always about owning property, buying stocks, or investing in mutual funds. It can also be in various types of alternative non-traditional assets. This concept has taken off, as it not only provides the joy of owning such assets but can also boost one’s wealth over time, ensuring that he/she enjoys the wealth alongside satisfying luxury desires.

In Asia, watches have appeared as the most widespread form of passion investment, with art coming in second place, followed by jewelry in the third. Classic cars came in fourth place, while wine came in fifth as per a Knight Frank Luxury Investment Index (KFLI) study.

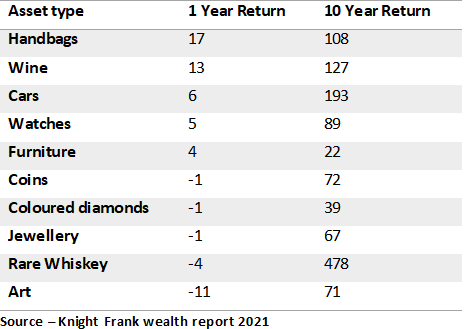

Passion investment returns (%), globally

Over 10 years, if you are buying the assets you love, you can double, triple, or even quadruple your investment, as shown in the table above. Rare whisky prices have grown over five times, while vintage car returns have tripled.

Diversification of portfolio

Passion investments are a good diversification tool and are relatively less volatile than the stock markets or short-term investment avenues. This niche market also bears a very low correlation with equities, providing some protection from general market fluctuations that invariably affect the bulk of investment portfolios.

Due to the increasing number of passionate investors and growing global wealth, passion investing can both be a rewarding and a fulfilling investment alternative for those who have an interest in these items. Furthermore, with demand for such assets growing internationally, your investment is not subject to the whims of a single economy and can be sold to the highest bidder in the global market. Family offices, HNIs (high net-worth individuals), and UHNIs (ultra high net-worth individuals) can allocate 2-5 percent of their portfolio to such asset classes that suit their interest. Financial advisors also play an important role here, as they can impart the requisite knowledge to the investors and help them build a well-diversified portfolio with a touch of passion investments suitable to their interest and wealth objective.

These types of investments typically tend to do well during times of economic uncertainty. However, their financial returns are far from assured or predictable. It is prudent to build a portfolio of such investments over time and diversify within this sub-asset class rather than putting all your eggs in one basket.

Undertaking detailed due diligence is vital for investors, as the available market intelligence and public information may be limited. It is imperative to know the asset, the seller, hidden costs, and the asset’s authenticity. The market is small, opaque, highly fragmented, unregulated, and usually has issues such as illiquidity and valuation subjectivity. A comprehensive due diligence process and experienced legal and transaction counsel can help investors take informed investment decisions and mitigate risk.

Passion investing should only be considered as a long-term investment strategy as a part of one’s wealth management strategy. It is best to choose the asset you have considerable knowledge in and are equally passionate about.